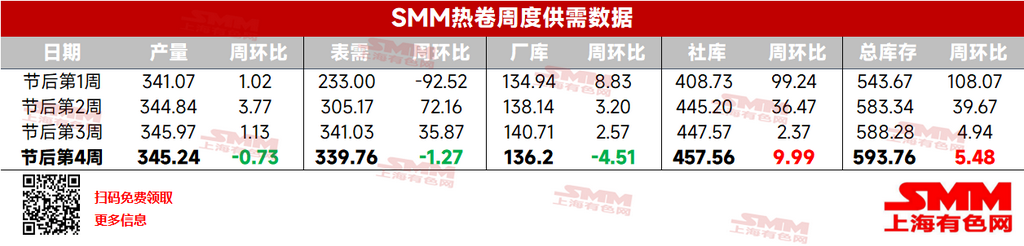

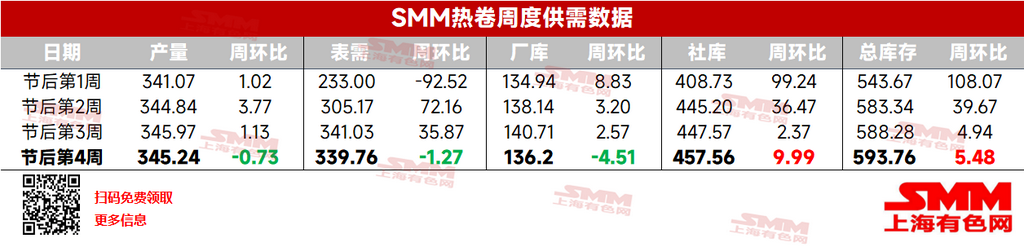

- SMM HRC Weekly Balance

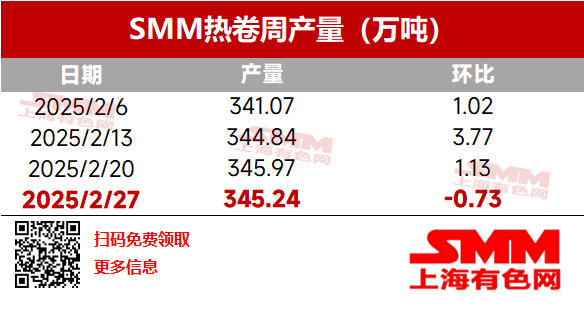

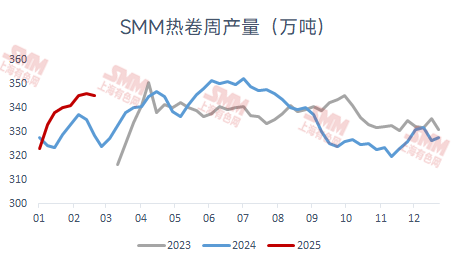

- HRC Production Slightly Declined This Week

This week, some steel mills in north China conducted maintenance on rolling mills and other equipment, leading to a slight decline in HRC production.

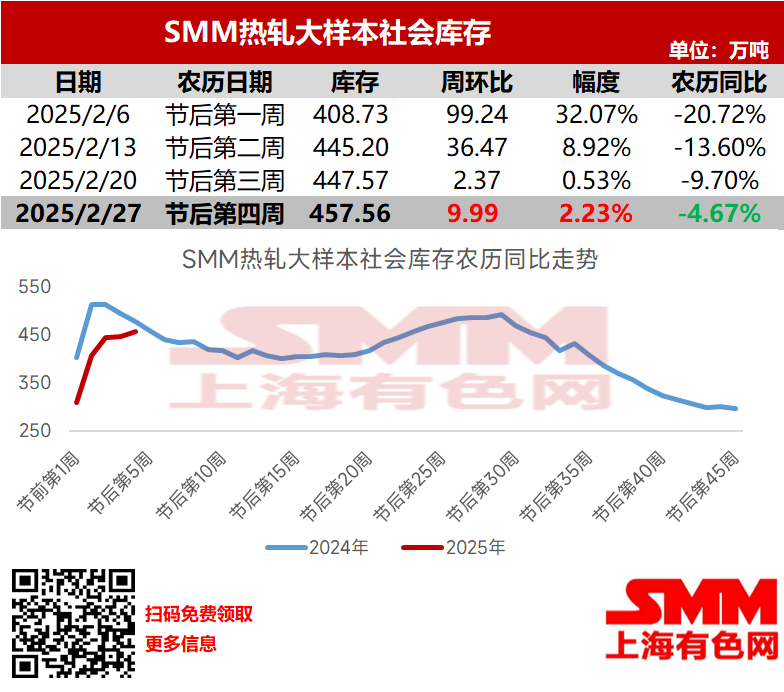

- HRC Social Inventory Growth Accelerated This Week

This week, SMM statistics showed that the HRC social inventory across 86 warehouses nationwide (large sample) reached 4.5756 million mt, up 99,900 mt or 2.23% MoM, and down 4.67% YoY based on the lunar calendar. Nationwide social inventory continued to accumulate this week, with the growth rate expanding. By region, inventories in central and north-east China saw slight declines, while those in east, south, and north China experienced inventory buildup. 【SMM Steel】

- HRC In-Plant Inventory Declined This Week

This week, steel mill inventories saw a slight decline.

Note:

1. SMM weekly HRC production/apparent demand/inventory data are based on a sample of 40 steel mills and 86 mainstream market warehouses nationwide.

2. As of October 31, 2024, SMM's weekly HRC production and steel mill inventory data covered 85% of the national HRC capacity.

3. SMM conducts surveys every Wednesday and releases the data on Thursday mornings.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)